December 2024 Real Estate Market Review

The in the Greater Edmonton Area (GEA) real estate scene closed December 2024 on an intriguing note, marked by low inventory and noteworthy price increases across different property types. For homebuyers, investors, and sellers alike, the December market trends offer valuable insight into what 2024 brought—and where 2025 might lead.

This blog provides a comprehensive review of the December 2024 real estate market in the GEA, complete with key statistics, market trends, and expert predictions. Whether you're navigating the current seller's market or planning your next move, understanding these data points and trends will help you make informed decisions.

The Current Real Estate Landscape in Greater Edmonton Area

The GEA real estate market ended 2024 with lower inventory levels but increased activity compared to December 2023. Let's break down the numbers and what they mean.

Residential Unit Sales

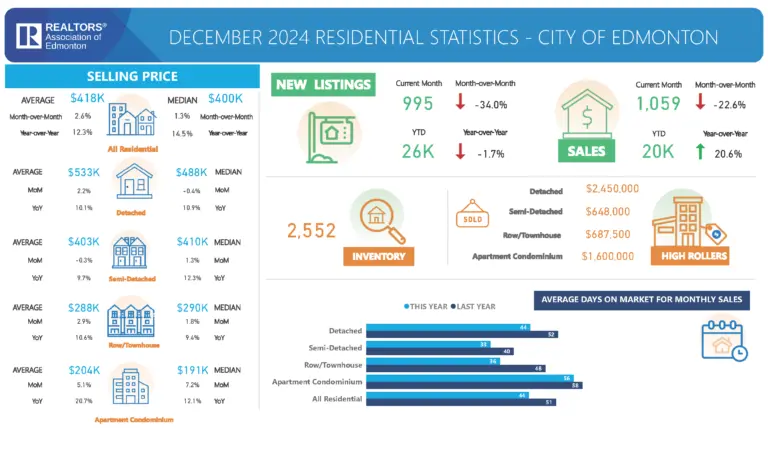

In December 2024, 1,428 residential units were sold across Edmonton—a 25.4% decrease from November but a 17.2% increase compared to December 2023. These year-over-year gains suggest growing buyer demand, even amidst the holiday season when activity typically slows.

However, a reduction in new listings may have moderated sales.

New Residential Listings

Around 1,367 new residential listings were recorded in December, indicating a 33.3% drop from November and a 7.3% decline from December 2023. The month-over-month decrease reflects seasonal trends, but the dip in year-over-year numbers suggests challenges in supply that could persist.

Overall Inventory

The total inventory of homes available in the GEA dropped significantly, decreasing 22.5% month-over-month and 24.6% year-over-year. These figures establish the continuation of a seller's market, where limited supply often drives fierce competition among buyers.

Unit-Type Breakdowns

- Detached Homes saw steady activity despite inventory constraints.

- Semi-Detached Units experienced robust demand and noticeable price growth.

- Apartment Condominiums, historically slower movers, also showed signs of improvement.

These dynamics indicate varying opportunities depending on specific housing categories.

Average Prices and Their Implications

Low inventory and sustained demand in the GEA pushed average home prices upward in December 2024. Here’s the breakdown by property type and key takeaways about the market implications.

Total Residential Prices

The overall average price of all residential properties in Edmonton hit $435,549, reflecting the sustained strength of the market despite fewer transactions.

Detached Homes

Detached properties continued to command high values, with an average price of $540,232, representing a 10.6% increase year-over-year. The appreciation in detached homes signals strong buyer interest and highlights their importance as a key driver in the market.

Semi-Detached Units

Semi-detached homes saw the sharpest pricing growth, climbing 12.3% from December 2023, solidifying their position as a desirable alternative to fully detached properties for many buyers.

Apartment Condominiums

Condominium units had a modest but steady gain, with prices rising 1.8% month-over-month to average $203,920 in December 2024. While this category has lagged behind in recent years, the trend of incremental gains signals recovery potential.

MLS® Home Price Index (HPI)

The composite benchmark price, as tracked by the MLS® Home Price Index, stood at $403,900. This measure, which reflects price trends more accurately than raw averages, continues to trend upward in sync with demand.

How Long Are Homes Staying on the Market?

Homes in the Edmonton market demonstrated faster turnover times in December 2024, pointing to motivated buyers and a competitive environment.

- Detached Homes spent an average of 44 days on the market.

- Semi-Detached Units turned over even faster, averaging just 33 days—a reflection of their growing appeal.

- On average, residential listings spent 44 days on the market, representing an 8-day improvement compared to December 2023.

This data shows that homes are selling significantly faster compared to a year ago, underscoring the intensity of the current seller's market.

What Does the Future Hold for the Edmonton Real Estate Market?

Looking to 2025, trends suggest continued low inventory, combined with resilient demand, will keep the GEA market competitive. Homebuyers may need to act quickly to secure properties, while sellers stand to benefit from favorable market conditions.

However, affordability challenges stemming from rising prices across property types will require careful consideration by buyers and investors. The potential for more listings in the new year may soften the competition slightly, but the fundamentals of supply and demand suggest that sellers will retain the upper hand for the foreseeable future.

Navigating the Market

The December 2024 real estate market in the Greater Edmonton Area was marked by low inventory, increased prices, and fast turnover rates—maintaining a seller’s market that benefits homeowners considering selling.

For buyers and investors, now is the time to act strategically. Whether you’re planning your next purchase or listing your property, staying informed and connected with trusted professionals is the key to making confident decisions in this competitive market.

If you’re ready to explore your options or need additional insights into the GEA market, stay tuned for more detailed reports or reach out to our local real estate team to guide you through the process.

Posted by Admin . on

Leave A Comment